The U.S. Small Business Administration (SBA) works with lenders to provide loans for small businesses across the country. An SBA 504 loan is a long-term financing solution for business owners to buy commercial real estate, machinery, equipment or other fixed assets.

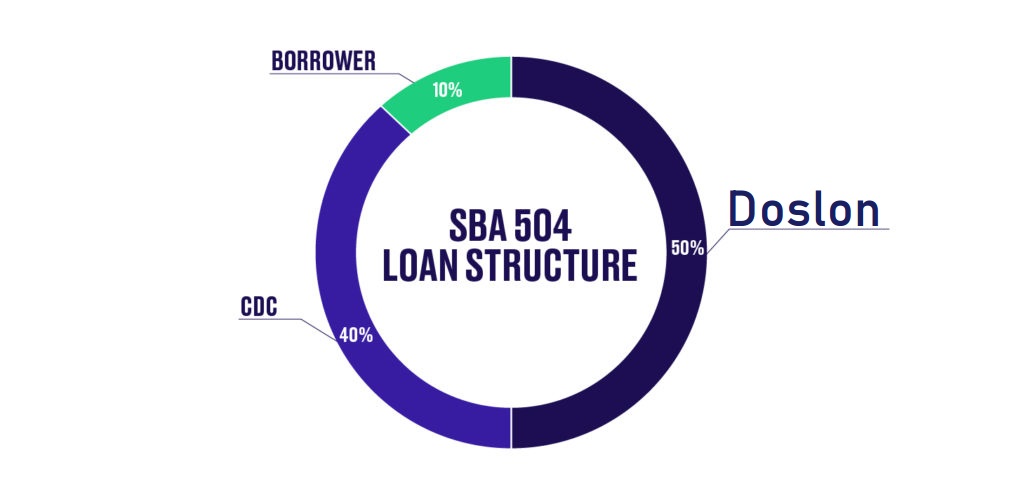

SBA 504 loans are structured differently than other SBA loan programs and it’s important to understand that 504 loans are composed of three distinct parts—the lender, Certified Development Company (CDC) and a borrower. In most cases, SBA 504 loans are structured in a 50-40-10 model. First is the lender(Sterbuck Capital NY.), which is 50% of the total amount. Second is a Certified Development Company (CDC) who provides 40% of the total loan amount. And third is the borrower who provides a 10% down payment. New businesses that have been in operation for less than two years, as well as special purpose properties, are required to provide an equity amount of 15%, creating a 50-35-15 structure. If you are both a new business AND a special purpose property, the borrower’s equity requirements change to 20%, following a 50-30-20 model.

Let’s talk through how a 504 loan works in real life. Robert is a small business owner who needs $1,000,000 to renovate his current building, as well as upgrade some heavy machinery for his business. His lender provides $500,000 for the first loan, while a CDC provides $400,000 through an SBA-guaranteed debenture and finally, Robert is responsible for the remaining $100,000 as a down payment. Robert will make payments on his 504 loan directly to his lender.

While the eligibility requirements for a 504 loan are nearly the same as for the 7(a) loan program, the approved uses of the loan are different. They fall into three main categories: buying commercial real estate, financing improvements within that real estate and purchasing large equipment. The maximum loan amount can be up to $15 million with maturity rates up to 25 years and low, multi-year fixed interest rates.

If you’re interested in learning more about SBA 504 loans and if this loan program would be a good fit for you, start the discussion with one of or expert on Sterbuck Capital NY. for assiatance.

SimpleTransparentSecure